Liquidity Planning for High-Net-Worth Families & Business Owners

Create liquidity without selling core assets — using conservatively structured, bank-backed premium financing.

Designed for clients with $2M+ net worth and complex planning needs.

We work alongside your existing advisors.

Strategic Premium Finance coordinates with CPAs, estate planning attorneys, trustees, and bank lending partners to evaluate and monitor premium financing strategies responsibly.

When Wealth Is Tied Up, Liquidity Becomes the Constraint

Many high-net-worth individuals hold the majority of their net worth in businesses, real estate, or long-term investments.

Creating liquidity often requires selling assets at the wrong time, triggering taxes, or disrupting long-term plans.

Premium financing is not about chasing returns — it’s about access, flexibility, and control when structured correctly.

The problem is not wealth. It’s liquidity.

Avoid forced liquidation

Reduce tax-trigger events

Preserve investment exposure

Create estate liquidity

When Wealth Is Tied Up, Liquidity Becomes the Constraint

Many high-net-worth individuals hold the majority of their net worth in businesses, real estate, or long-term investments.

Creating liquidity often requires selling assets at the wrong time, triggering taxes, or disrupting long-term plans.

Premium financing is not about chasing returns — it’s about access, flexibility, and control when structured correctly.

Proper trust structures

Bank backed life insurance strategies

Coordinated planning with CPAs and attorneys

Long-term monitoring and risk controls

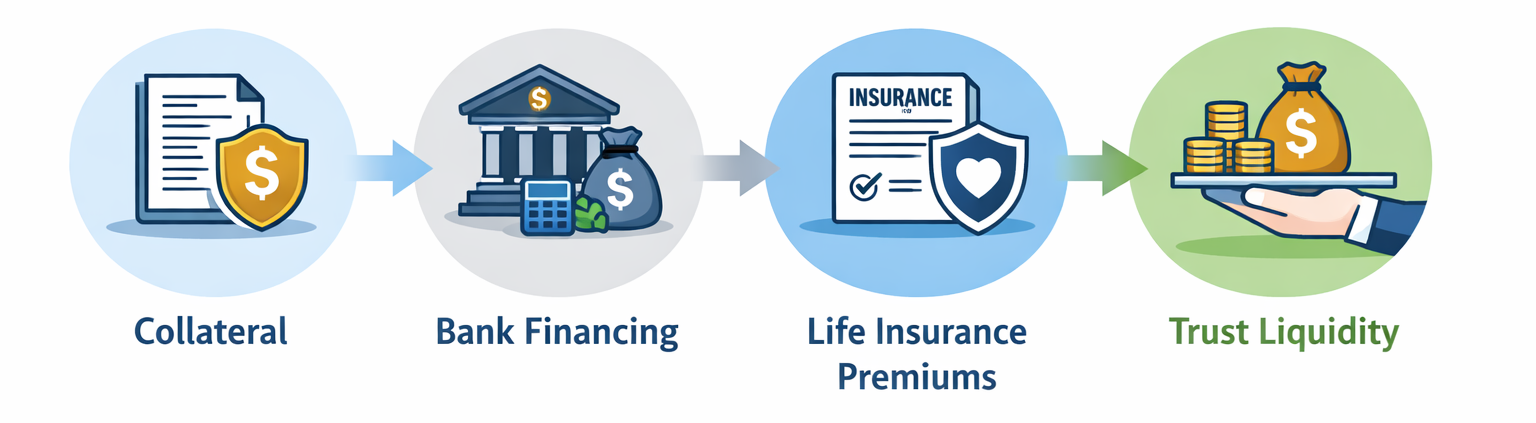

What Is Premium Financing

Premium financing is a planning strategy that uses bank financing to fund life insurance premiums, allowing qualified clients to preserve capital, maintain investment exposure, and create long-term liquidity.

When designed conservatively and monitored properly, it can serve as a powerful complement to broader estate and financial planning.

Use bank financing to fund large life insurance policies

Preserve personal capital for business or investments

Create liquidity for estate planning

Transfer wealth efficiently through trusts

This strategy is not about chasing returns — it’s about access, flexibility, and control

Who This Strategy Is Designed For

Premium financing is not appropriate for everyone.

It is typically considered by:

High-income earners ($300K+)

Business owners

Crypto investors

Real estate investors

Estate/legacy focused families

Clients with existing CPA/attorney teams

Suitability is determined through analysis — not assumptions.

Who This Strategy Is Designed For

Premium financing is not appropriate for everyone.

It is typically considered by:

- High-income earners with $300K+ annual income

- Business owners with retained earnings or illiquid equity

- Cryptocurrency investors with significant digital asset exposure

- Real estate investors with substantial equity tied up in properties

- Families focused on estate and legacy planning

- Professionals working with CPAs, attorneys, and trustees

Each situation requires careful evaluation. Suitability is determined through analysis — not assumptions.

A Disciplined, Step-by-Step Process

- No pressure.

- No product pushing.

- Only clarity and alignment.

Risk Management Is Not Optional

Premium financing introduces leverage, interest rate exposure, and long-term commitments.

That’s why our approach emphasizes:

Conservative assumptions

Clear insights into interest rates for stronger, more confident planning.

Stress-tested scenarios

We help structure collateral to protect assets and support financing.

Exit strategy planning

Plan smart exits that protect value, reduce risk, and maximize returns.

Ongoing monitoring and reporting

Ongoing tracking keeps your financing optimized, secure, and responsive.

A Planning-First Approach

Strategic Premium Finance exists to help qualified clients evaluate liquidity strategies responsibly.

We do not replace your advisors — we work alongside them.

Our role is to bring structure, coordination, and ongoing oversight to complex premium financing arrangements.

Frequently Asked Questions

Any leveraged strategy carries risk. Proper structure and monitoring are essential.

Often yes, especially for estate and legacy planning.

Most strategies are suitable for individuals with strong income and long term planning horizons.

In certain structures, yes depending on underwriting and design.

No. We work alongside your CPA, attorney, and wealth professionals.

Request a Confidential Strategy Session

If you’re exploring whether premium financing fits into your broader planning strategy, the first step is a brief fit check.

No obligation. No pressure. Just clarity.

Book Your Free Private Strategy Call

Confidential. No obligation. Advisor-coordinated.

- (305) 903-0363

- info@strategicpremiumfinance.com