Tax-Efficient Estate Planning Strategies for High-Net-Worth Individuals & Families

Preserve Wealth, Minimize Estate Taxes & Ensure a Smooth Legacy Transfer

Discover the best tax-efficient estate planning strategies for high-net-worth individuals. Learn how to minimize estate taxes, protect generational wealth, and structure trusts and ILITs for seamless wealth transfer.

Tax-Efficient Estate Planning Strategies for High-Net-Worth Individuals & Families

Effective tax-efficient estate planning strategies for high-net-worth individuals help minimize estate taxes, maximize wealth protection, and ensure a seamless financial legacy for future generations.

Fill out the form below to get instant access to expert tips, exclusive offers, and more!

Why Estate Planning is Critical for High-Net-Worth Individuals & Families

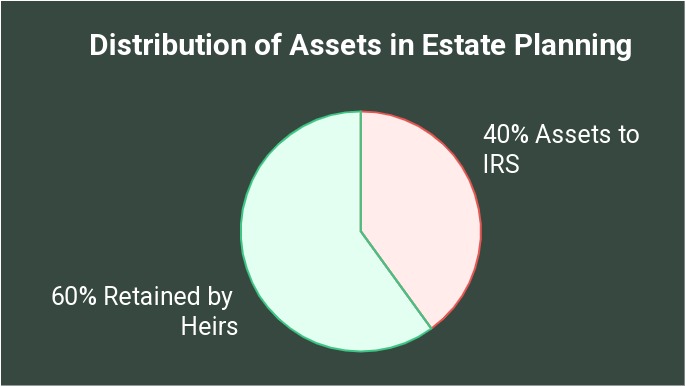

Estate planning isn’t just about who inherits your wealth—it’s about how they inherit. Without proper planning, the IRS could claim up to 40% of your estate, legal fees can mount, and heirs could face years of probate delays.

Key Risks of Poor Estate Planning:

Massive Estate Tax Liabilities

Without using the federal exemption wisely, families risk losing millions.

Legal Battles & Probate Costs

Without a trust, expect long delays, high fees, and court involvement.

Loss of Privacy & Control

Wills are public and limited in scope. Trusts ensure privacy and structured wealth distribution.

Strategic estate planning gives you control, protection, and peace of mind.

Proven Tax-Efficient Estate Planning Strategies to Reduce Estate Taxes

1. Irrevocable Life Insurance Trusts (ILITs)

- Exclude life insurance proceeds from your estate.

- Provide tax-free liquidity to cover estate taxes.

- Use premium financing to preserve your cash flow.

2. Dynasty Trusts (Multi-Generational)

- Lock in generational tax exemptions.

- Grow wealth tax-free across generations.

- Shield assets from divorce, creditors, and lawsuits.

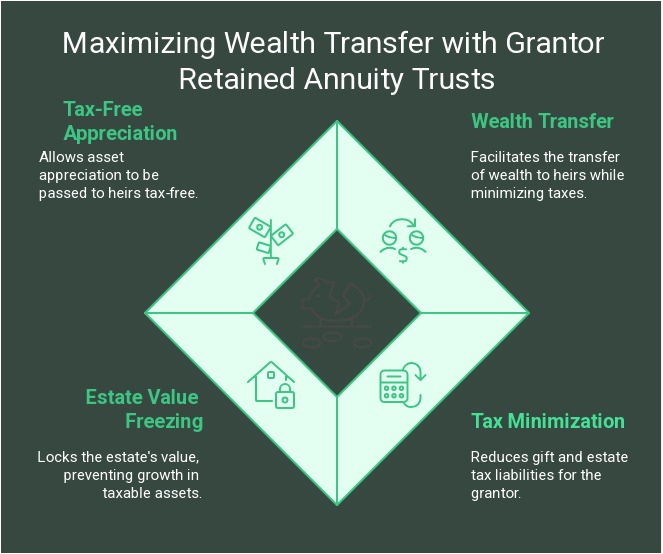

3. Grantor Retained Annuity Trusts (GRATs)

- Transfer asset growth to heirs with minimal gift tax.

- Freeze estate values now and shift appreciation out of the estate.

- Ideal for rapidly appreciating assets (stocks, businesses).

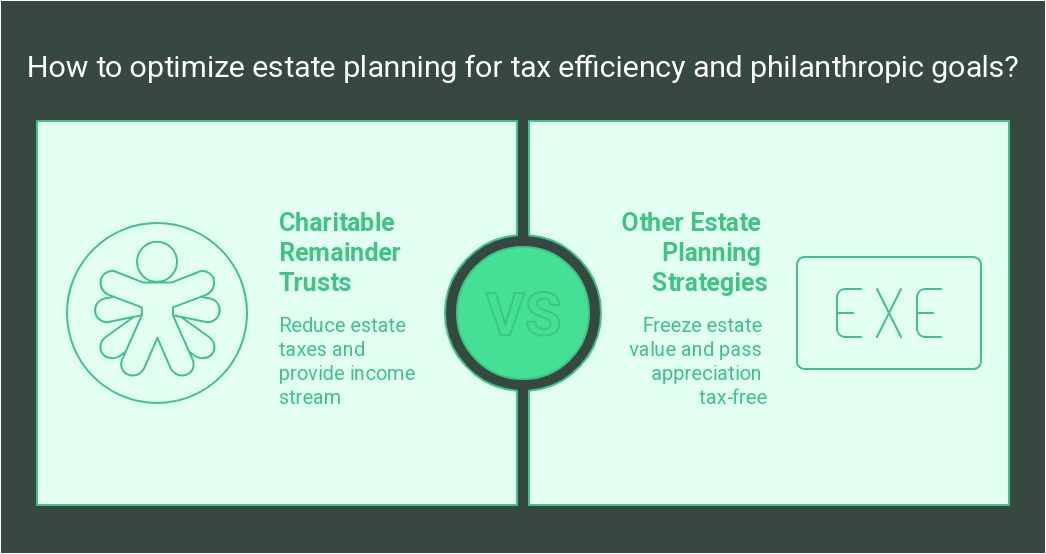

4. Charitable Remainder Trusts (CRTs)

- Offset capital gains by donating appreciated assets.

- Receive income for life; leave the remainder to charity.

- Lower taxable estate and support a cause.

5. Business Succession Planning

- Avoid forced sale of a family business.

- Use buy-sell agreements, ESOPs, or private annuities.

- Lower capital gains while passing on control smoothly.

How Trusts, ILITs, and Legal Structures Protect & Preserve Your Wealth

Feature | Will | Trust |

Avoids Probate? | ❌ No | ✅ Yes |

Reduces Estate Taxes? | ❌ No | ✅ Yes |

Provides Asset Protection? | ❌ No | ✅ Yes |

Controls Wealth Transfer? | ❌ No | ✅ Yes |

Keeps Assets Private? | ❌ No | ✅ Yes |

A simple will is not enough for high-net-worth families. Trusts, ILITs, and legal entities offer tax efficiency, control, and protection from litigation.

Who Needs Advanced Estate Planning & How to Get Started

Ideal Clients:

-

Net worth $5M+

-

Business owners

-

Real estate investors

-

Families concerned about legal exposure

If you own multiple properties, a business, or anticipate a large estate transfer, failing to plan could devastate your heirs financially.

Now is the time to take advantage of historically high estate exemptions before they sunset in 2026.

Real-World Case Study: $12M Saved with Strategic Planning

“The only regret was not doing this sooner.”

Client Profile:

$30M real estate investor

Challenge:

$12M projected estate tax burden

Strategy:

- ILIT with $10M insurance policy

- Dynasty Trust with valuation discounts

- GRAT for appreciating investment assets

Result:

- Taxable estate reduced to nearly zero

- No forced sale of properties

- Smooth, tax-efficient legacy transfer

Secure Your Wealth & Protect Your Legacy Today

Would you rather lose millions to the IRS or ensure your heirs receive your legacy in full?

Let us help you structure a plan that ensures your family receives everything you’ve worked so hard to build.

-

Book Your Free Strategy Session Now

-

Call: 305-903-0363

-

Email: info@strategicpremiumfinance.com

-

Serving High-Net-Worth Clients Nationwide

Discover the best tax-efficient estate planning strategies for high-net-worth individuals. Learn how to minimize estate taxes, protect generational wealth, and structure trusts to ensure smooth wealth transfer.

Tax-Efficient Estate Planning Strategies for High-Net-Worth Individuals & Families

Effective tax-efficient estate planning strategies for high-net-worth individuals help minimize estate taxes, maximize wealth protection, and ensure a seamless financial legacy for future generations.

Why Estate Planning is Critical for High-Net-Worth Individuals & Families

Estate planning is not just about writing a will—it’s about ensuring your wealth stays in your family and out of the hands of the IRS. High-net-worth individuals risk losing up to 40% of their estate to taxes if they fail to structure their wealth properly.

Estate tax laws are complex and constantly evolving, making it essential to have a structured, tax-efficient estate plan that ensures your wealth is transferred efficiently, legally, and with minimal tax exposure.

The Cost of Poor Estate Planning: Why Most Families Lose Millions

The Government is Taking a Large Portion of Your Wealth

Estate taxes can claim up to 40% of your assets, meaning nearly half of your wealth could go to the IRS instead of your heirs.

Without proper tax-efficient estate planning, your family may be forced to sell assets at a loss to cover tax liabilities.

Legal Battles & Probate Can Drain Your Estate

Without structured trusts and asset protection, heirs can face years of legal disputes, probate costs, and financial instability.

Probate fees, attorney costs, and creditor claims can significantly reduce the value of your estate.

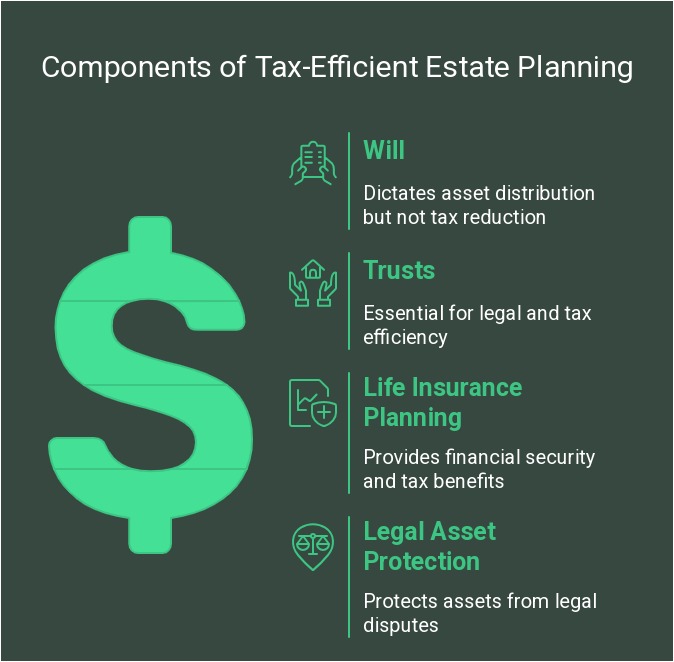

A Simple Will is Not Enough

A will only dictates asset distribution—it does NOT reduce taxes or protect against legal disputes.

Trusts, life insurance planning, and legal asset protection are essential for preserving and maximizing generational wealth.

Proven Tax-Efficient Estate Planning Strategies to Reduce Estate Taxes

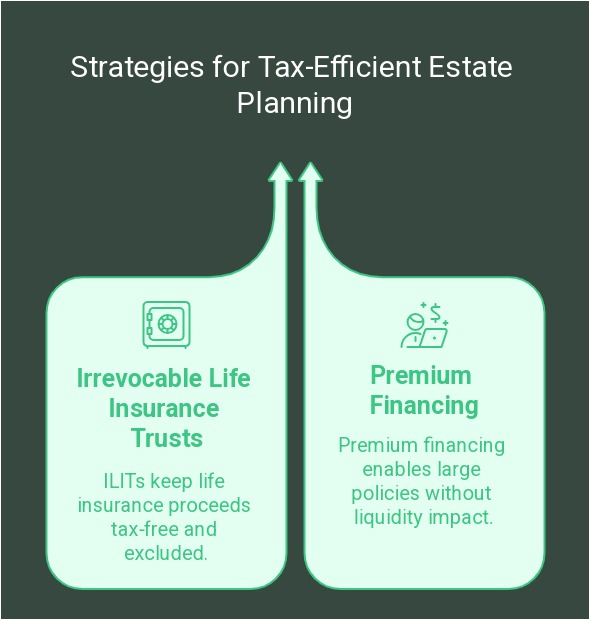

Leverage Irrevocable Life Insurance Trusts (ILITs)

An ILIT keeps life insurance proceeds outside of your taxable estate, ensuring that your beneficiaries receive the full payout tax-free.

Using ILITs with premium financing allows high-net-worth individuals to secure large life insurance policies without affecting liquidity.

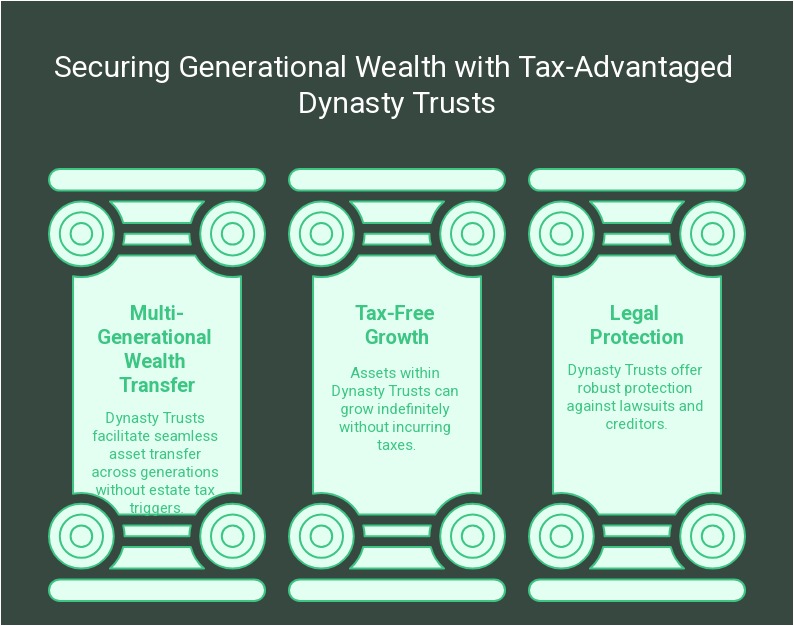

Use Dynasty Trusts for Multi-Generational Wealth Transfer

Dynasty Trusts allow your heirs to inherit assets without triggering estate taxes for multiple generations.

Assets inside a properly structured Dynasty Trust can continue to grow tax-free while protecting against lawsuits and creditors.

Establish Grantor Retained Annuity Trusts (GRATs)

GRATs allow individuals to transfer wealth to heirs while minimizing gift and estate taxes.

The value of the estate is frozen, meaning that appreciation of assets inside the trust is passed to heirs tax-free.

Utilize Charitable Remainder Trusts (CRTs) for Tax-Free Growth

Charitable Remainder Trusts reduce estate taxes by donating a portion of assets to charity while providing an income stream for beneficiaries.

Highly effective for real estate investors & business owners looking for tax-efficient philanthropic giving.

Implement Business Succession Planning & Tax Optimization

Business owners can avoid estate taxes by using buy-sell agreements, ESOPs, and private annuity sales.

Family business owners can structure tax-efficient transitions to heirs while minimizing capital gains tax.