Take Control of Your Business Risk & Tax Strategy with Captive Insurance

Captive Insurance Solutions for Business Tax Savings & Risk Management

Why Smart Business Owners Use Captive Insurance to Lower Taxes & Build Wealth

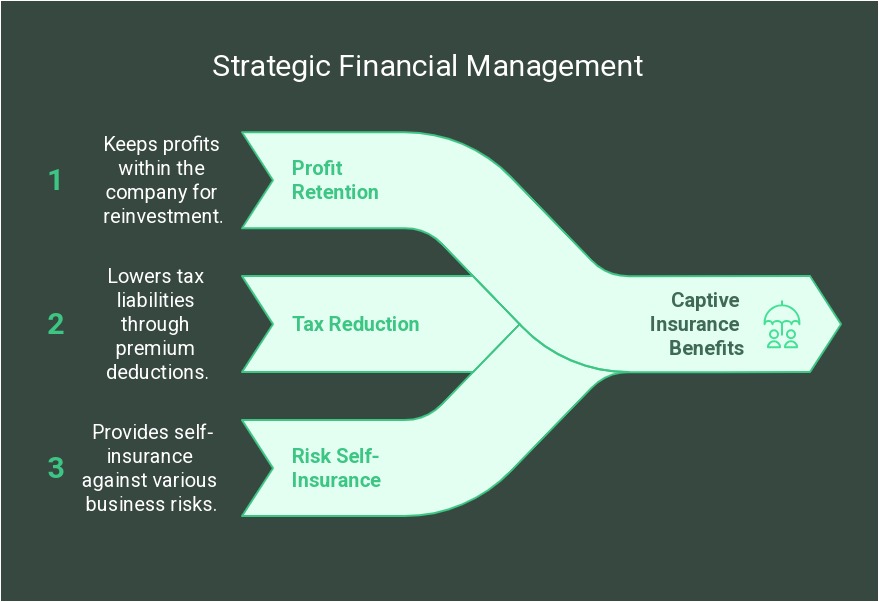

Captive insurance solutions for business tax savings and risk management allow business owners to take control of their risk while reducing tax liabilities and creating a tax-efficient wealth-building strategy. Instead of paying high premiums to third-party insurance companies with no long-term benefits, business owners can establish their own private insurance company to retain profits, self-insure against risks, and maximize tax advantages.

What is Captive Insurance & Why Do Fortune 500 Companies Use It?

Captive insurance is a strategic risk management tool that enables business owners to set up their own insurance company to cover specific risks while unlocking powerful tax savings. Major corporations like Amazon, Tesla, and Google have used this strategy for decades to lower costs, protect assets, and build long-term wealth.

"Why keep paying millions to third-party insurers when you can own the insurance company and turn premiums into profits?"

-

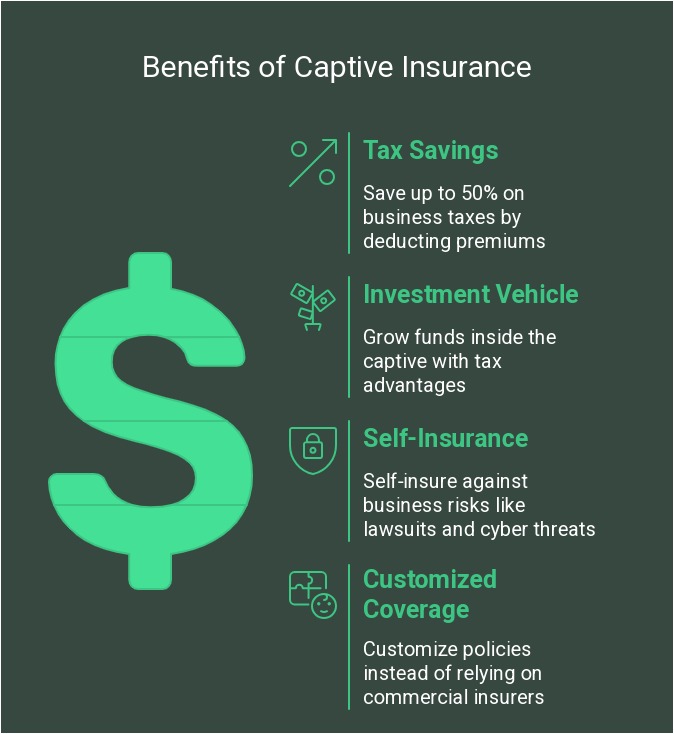

Save up to 50% on business taxes by deducting premiums paid into the captive as business expenses.

-

Create a tax-free investment vehicle by growing funds inside the captive with tax advantages.

-

Self-insure against business risks such as lawsuits, cyber threats, supply chain issues, and market volatility.

-

Gain full control over your insurance coverage instead of relying on commercial insurers with expensive policies and coverage gaps.

Fill out the form below to get instant access to expert tips, exclusive offers, and more!

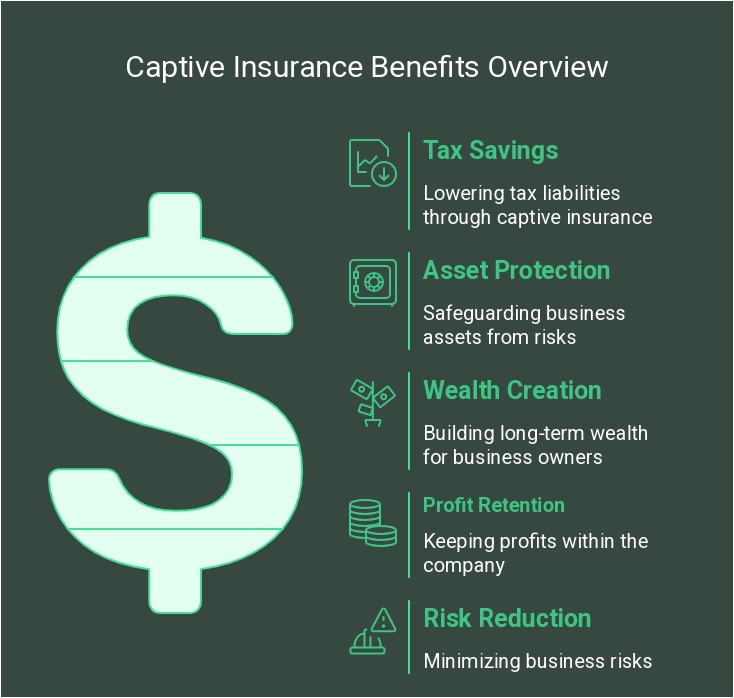

The Biggest Tax Savings Benefits of Captive Insurance Solutions

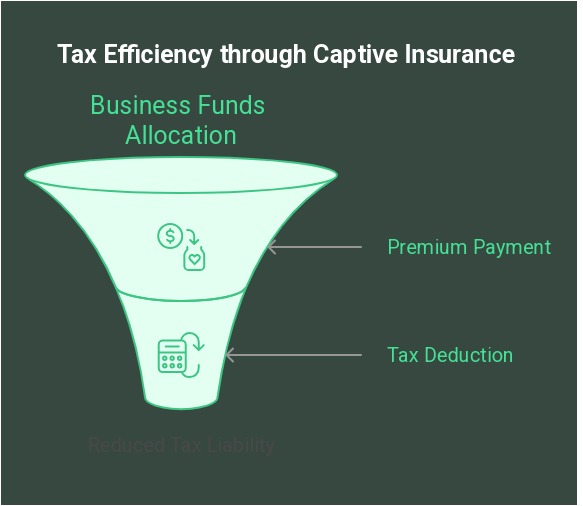

Reduce Taxable Income While Building a Protected Reserve

Captive insurance is a strategic risk management tool that enables business owners to set up their own insurance company to cover specific risks while unlocking powerful tax savings. Major corporations like Amazon, Tesla, and Google have used this strategy for decades to lower costs, protect assets, and build long-term wealth.

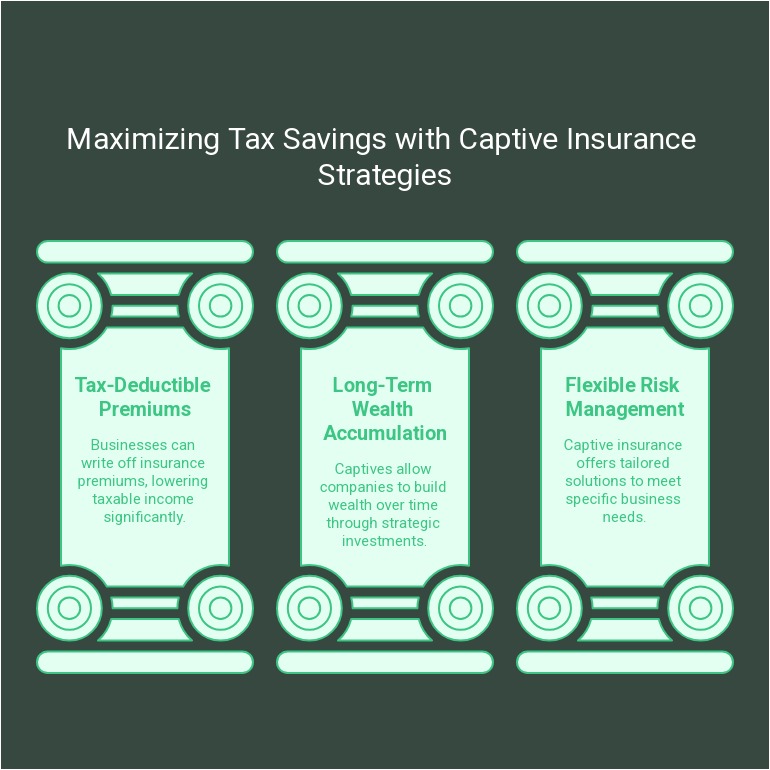

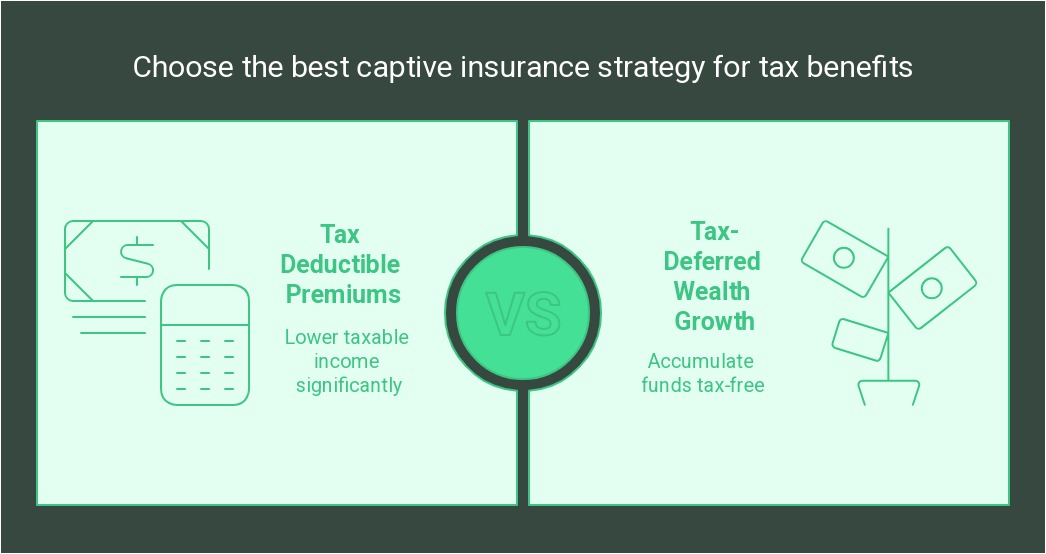

Tax-Deductible Premiums

Businesses can write off insurance premiums paid into the captive, lowering taxable income significantly.

Tax-Deferred Wealth Growth

Unlike traditional insurance policies, funds inside a captive insurance company accumulate tax-free.

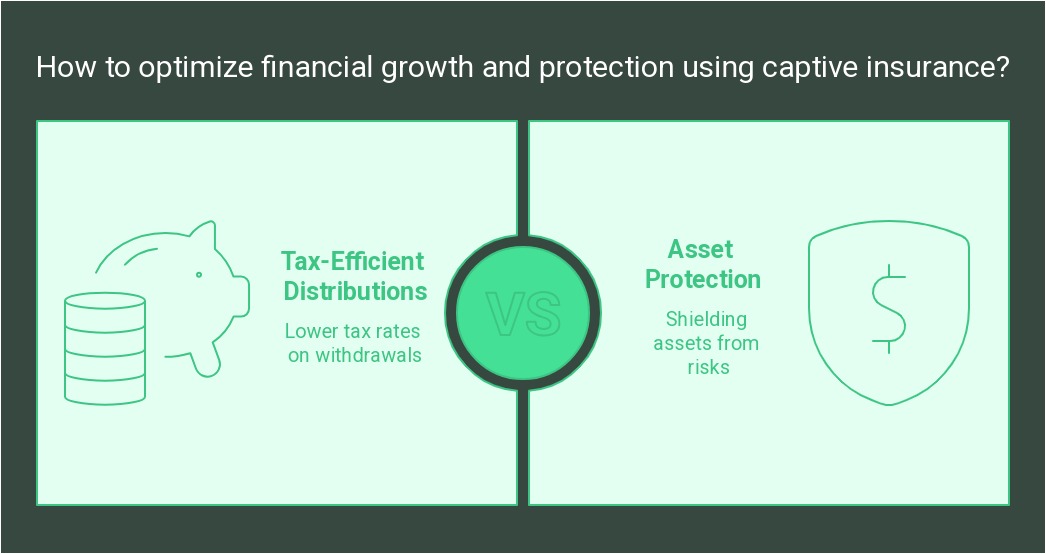

Tax-Efficient Distributions

Owners can withdraw funds from the captive at lower tax rates, creating a powerful tax-efficient strategy.

Asset Protection

A captive insurance company shields business assets from lawsuits, creditors, and financial risks.

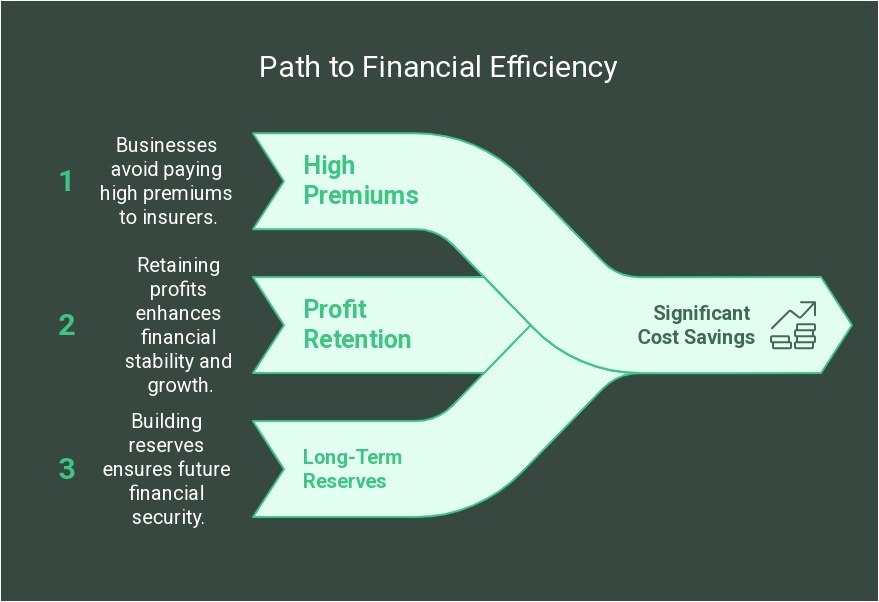

Significant Cost Savings

Instead of paying high premiums to third-party insurers, businesses retain profits and build long-term reserves.

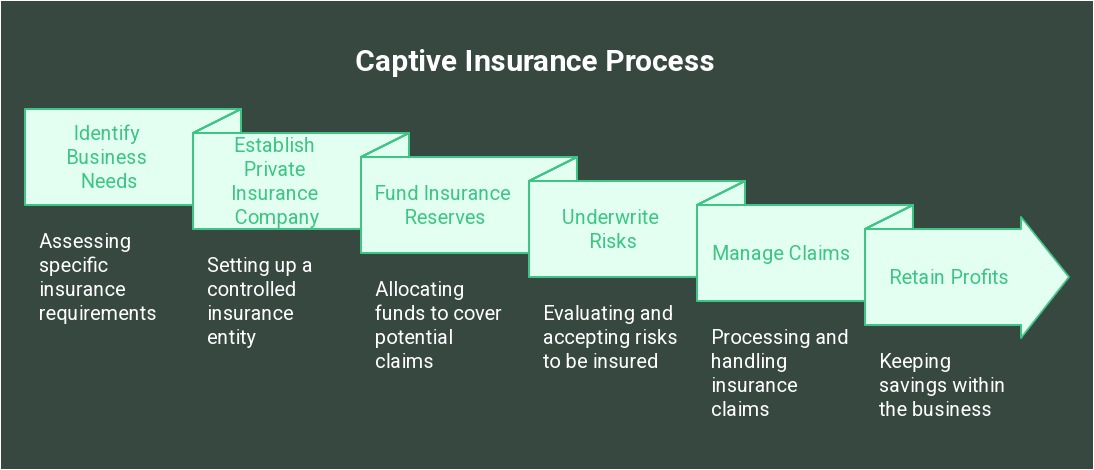

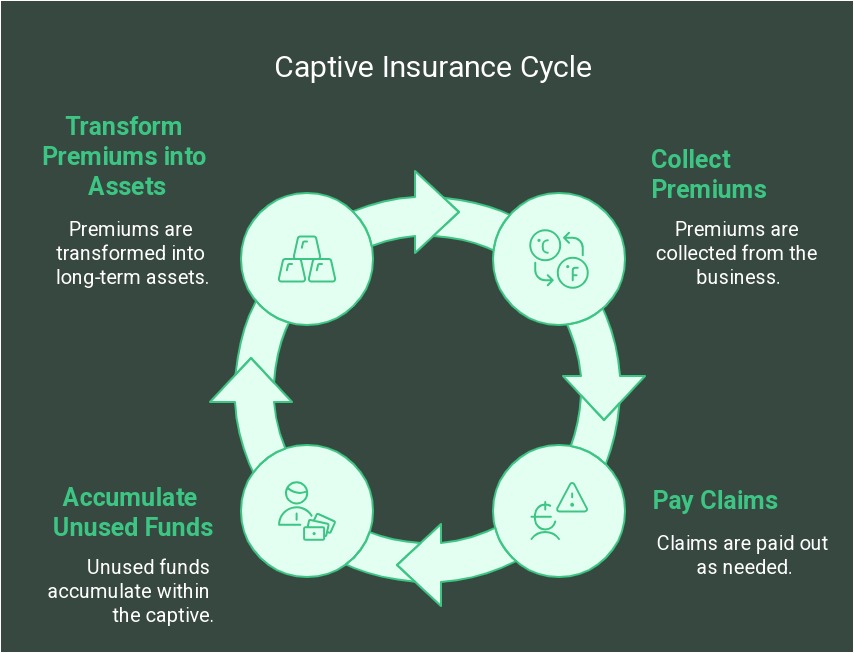

How Captive Insurance Works – Step-by-Step Process

A Simple, Strategic Path to Lower Taxes & Greater Financial Control

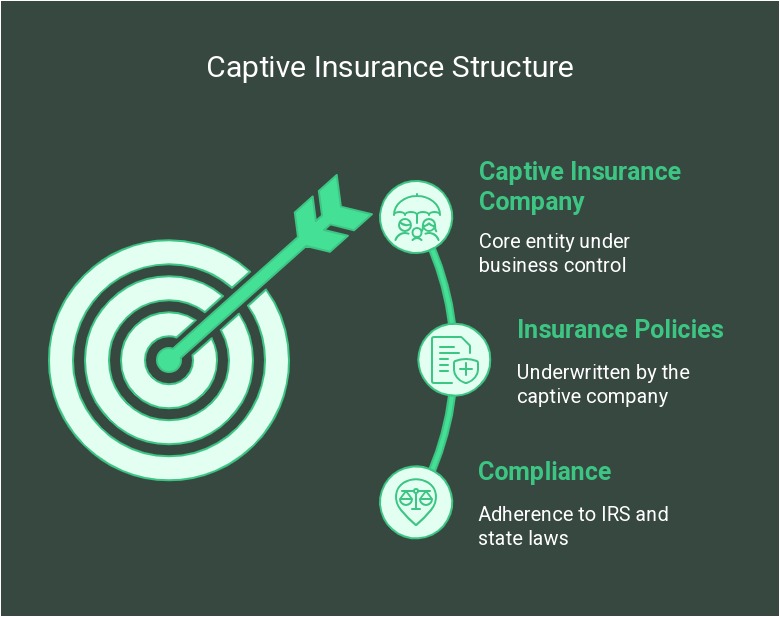

Step 1: Establish a Private Insurance Company

- A captive insurance company is formed under your business’s ownership, licensed to underwrite insurance policies.

- The captive is structured in compliance with IRS tax laws and state regulatory requirements.

Step 2: Redirect Premiums to Your Captive Insurance Company

- Your business pays premiums into the captive instead of third-party insurers.

- These funds are classified as deductible business expenses, lowering taxable income.

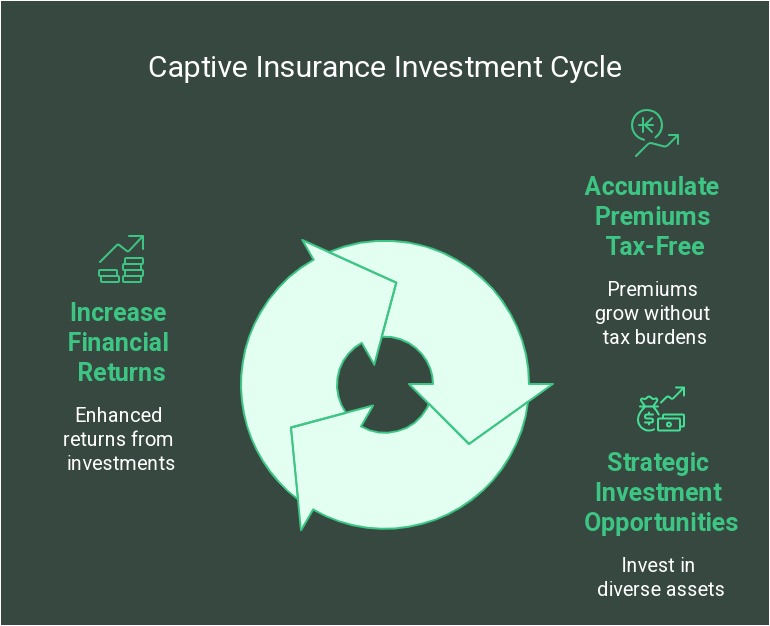

Step 3: Allow Premiums to Accumulate Tax-Free

- Unlike traditional insurance, money inside the captive is retained and grows tax-free.

- These funds can be invested in real estate, equities, or alternative assets, further increasing financial returns.

Step 4: Claims Are Paid Out as Needed

- The captive operates like a traditional insurer, covering specific business risks.

- Any unused funds remain in the captive, turning insurance premiums into long-term assets.

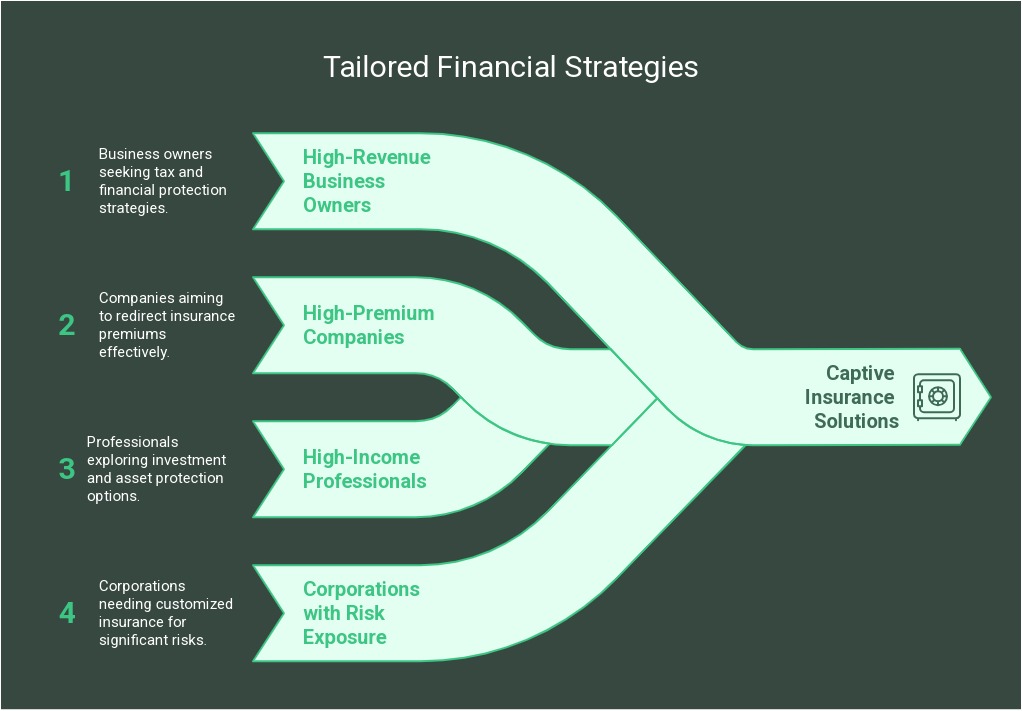

Who Qualifies for Captive Insurance & How to Get Started

Is Captive Insurance Right for Your Business?

-

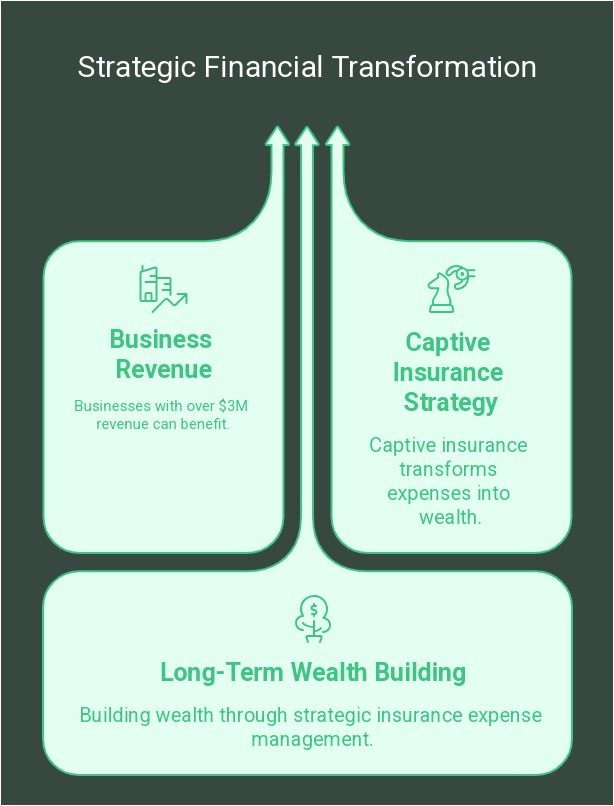

Business owners generating $3M+ in annual revenue looking to reduce tax liabilities and increase financial protection.

-

Companies paying $250K+ annually in insurance premiums that could be redirected into their own captive.

-

High-income professionals and private investors seeking alternative investment vehicles and asset protection strategies.

-

Corporations with significant risk exposure needing customized insurance solutions instead of expensive commercial policies.

If you meet these criteria, you may qualify for a captive insurance structure that reduces taxes, increases profits, and secures financial protection.

Case Study: How Fortune 500 Companies Use Captive Insurance to Build Wealth

Client Profile: A manufacturing company generating $15M+ in annual revenue was paying over $800K per year in insurance premiums to third-party insurers.

The Problem:

- No control over insurance coverage.

- Premiums were rising yearly, increasing business costs.

- No long-term financial benefit from these expenses.

The Solution:

- A captive insurance company was established, allowing the business to self-insure and retain premium payments.

- Instead of paying a commercial insurer, the company redirected premiums into its own captive.

The Results:

- After five years, the captive had accumulated over $4M in assets, which could be used for future claims, investments, or business growth.

- The business saved over $2M in taxes while reducing exposure to external insurers.

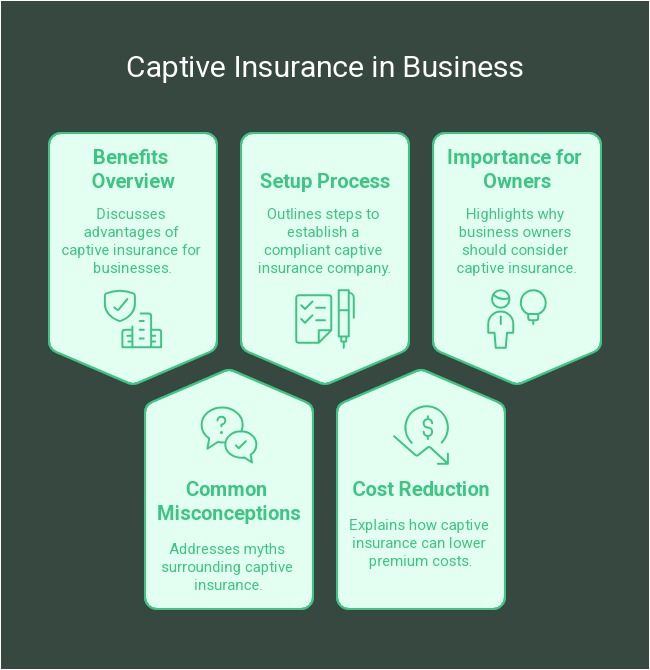

Common Myths & Misconceptions About Captive Insurance

Objection: “Is This Legal?”

- Yes! Captive insurance companies are fully IRS-compliant when structured properly.

- Fortune 500 companies have used captive insurance for decades as a legitimate risk-management tool.

Objection: “I Already Have Business Insurance”

- Traditional insurance only covers broad risks, while captive insurance allows full customization.

- Instead of paying high premiums to outside insurers, you retain those funds and build wealth.

Objection: “Isn’t Setting Up a Captive Expensive?”

- The long-term tax savings and wealth accumulation far outweigh setup costs.

- Most businesses with $3M+ in revenue see a strong ROI within the first few years.

Why Captive Insurance is a Game-Changer for Business Owners

Would you rather:

Keep paying millions in insurance premiums to third-party insurers?

OR

Establish your own insurance company, reduce taxes, and turn premiums into a wealth-building asset?

With captive insurance, you take control of your risk, lower your tax bill, and transform insurance expenses into long-term financial growth.

-

Take Control of Your Business Taxes & Risk Today

-

Book a Free Captive Insurance Strategy Session

-

Call: 305-903-0363

-

Email: info@optimizedwealthstrategies.com

-

Serving High-Net-Worth Clients Nationwide

Captive insurance solutions for business tax savings and risk management

Discover how captive insurance solutions for business tax savings and risk management can help business owners lower tax liabilities, protect assets, and create long-term wealth. Learn how Fortune 500 companies use captive insurance to retain profits and reduce risks.

Captive Insurance Solutions for Business Tax Savings & Risk Management

Captive insurance solutions for business tax savings and risk management allow business owners to take control of their risk while reducing tax liabilities and creating a tax-free wealth-building strategy.

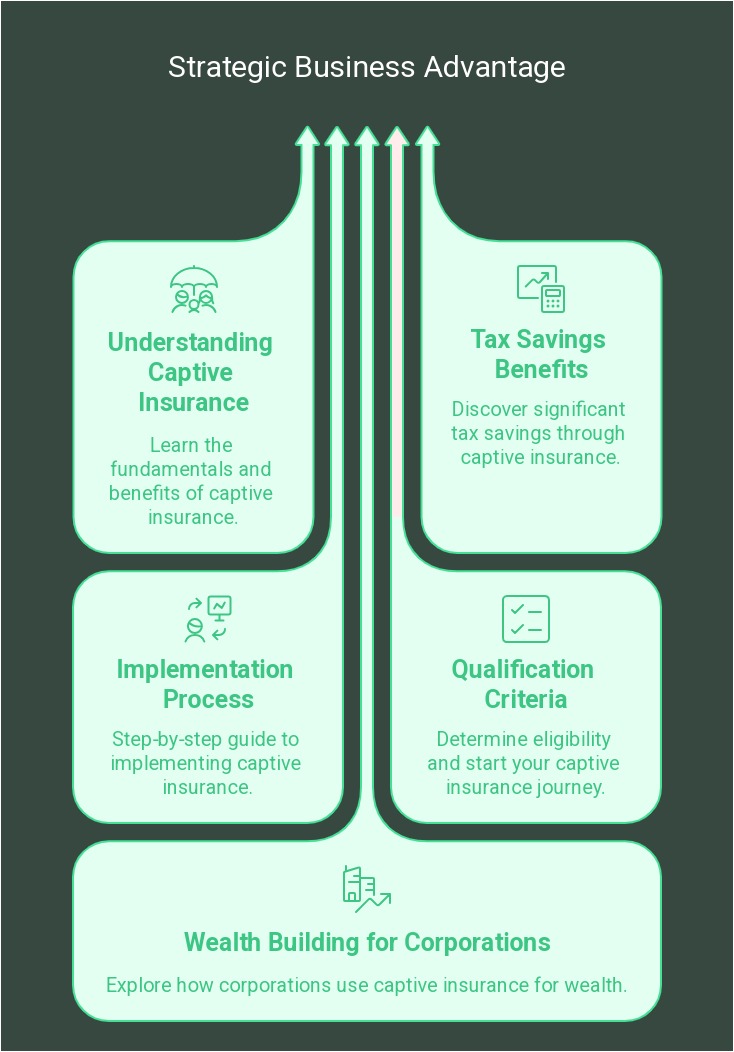

What is Captive Insurance & Why Do Smart Business Owners Use It?

The Biggest Tax Savings Benefits of Captive Insurance Solutions

How Captive Insurance Works: Step-by-Step Process

Who Qualifies for Captive Insurance & How to Get Started

How Fortune 500 Companies Use Captive Insurance to Build Wealth

The Role of Captive Insurance in Business Tax Planning

Why Business Owners Should Consider a Captive Insurance Company

How Captive Insurance Helps Reduce Premium Costs & Retain Profits

Common Myths & Misconceptions About Captive Insurance

How to Set Up a Compliant Captive Insurance Company

What is Captive Insurance & Why Do Smart Business Owners Use It?

Did you know that Fortune 500 companies and large corporations operate their own private insurance companies to retain profits, reduce taxes, and self-insure against risk?

Captive insurance allows business owners to set up their own insurance company instead of relying on expensive third-party insurers. This strategy enables companies to:

Save up to 50% on business taxes by deducting premiums paid into the captive as business expenses.

Create a tax-free investment vehicle by growing funds inside the captive with tax advantages.

Self-insure against business risks such as lawsuits, cyber threats, supply chain issues, and market volatility.

Gain greater control over coverage by customizing policies instead of relying on commercial insurers with high fees and broad coverage gaps.

Captive insurance isn’t just for large corporations—businesses earning over $3M per year can leverage this strategy to transform insurance expenses into long-term wealth.

The Biggest Tax Savings Benefits of Captive Insurance Solutions

Tax Deductible Premiums

Businesses can write off insurance premiums paid into the captive, lowering taxable income significantly.

Tax-Deferred Wealth Growth

Unlike traditional insurance policies, the funds inside a captive insurance company accumulate tax-free, allowing for long-term financial growth.

Tax-Efficient Distributions

When structured properly, owners can withdraw funds from the captive at lower tax rates, providing a powerful tax-efficient wealth accumulation tool.

Asset Protection

A captive insurance company shields business assets from lawsuits, creditors, and financial risks, ensuring stronger financial security.

Significant Cost Savings

Instead of paying high premiums to third-party insurers, businesses retain profits and build long-term reserves.

How Captive Insurance Works: Step-by-Step Process

Step 1: We Establish a Private Insurance Company Under Your Control

A captive insurance company is formed under your business’s ownership, licensed to underwrite insurance policies.

The captive is structured in compliance with IRS tax laws and state regulatory requirements.

Step 2: You Pay Premiums into the Captive, Reducing Taxable Income

Your business redirects funds into the captive instead of paying high commercial insurance premiums.

These funds are classified as deductible business expenses, reducing taxable income.

Step 3: Premiums Accumulate Tax-Free & Can Be Invested Strategically

Unlike traditional insurance, money inside the captive is retained and grows tax-free.

These funds can be strategically invested in real estate, equities, or alternative assets, further increasing financial returns.

Step 4: Claims Are Paid Out as Needed, Just Like a Traditional Insurance Company

The captive operates like a traditional insurer, covering specific business risks as needed.

Any unused funds accumulate within the captive, turning insurance premiums into long-term assets.

Who Qualifies for Captive Insurance & How to Get Started

Business owners generating $3M+ in annual revenue who want to reduce tax liabilities and increase financial protection.

Companies paying $250K+ annually in insurance premiums that could be redirected into their own captive.

High-income professionals and private investors seeking alternative investment vehicles and asset protection strategies.

Corporations with significant risk exposure that need customized insurance solutions instead of expensive commercial insurance policies.