Premium Financing Helps Protect Your Wealth. Keep Your Cash. Build a Larger Legacy Without Touching Your Liquidity.

Ultra high net worth families, investors & business owners use The Legacy Multiplier Program™ to unlock $10M–$50M+ of tax efficient protection without paying large premiums out of pocket.

Top Carriers • Private Bank Funding • Attorney & CPA Coordinated • 100% Confidential

New Features

The bank pays for the policy. You keep your money working elsewhere. Your family gets the benefit.

The Only Wealth Strategy That Lets You Have It All

Book your free 30-minute consultation today. No pressure, just clarity.

All inquiries kept 100% Confidential

We’re here to help

This is the strategy wealthy families use to multiply their legacy without sacrificing their capital.

- 305-903-0363

- info@strategicpremiumfinance.com

Premium financing means:

A bank pays the life insurance premiums for you.

You keep your money.

Your policy grows.

Your family gets protected.

That’s it.

Wealthy families use this to:

Reduce Estate Taxes

Create Tax Free Inheritance

Protect Businesses

Safeguard Their Real Estate Empire

Build Generational Wealth

All while keeping their investment capital untouched.

The Legacy Multiplier Program™ A Done for You, Bank Funded Estate Protection System Designed for High Net Worth Families.

What You Get:

-

1. $10M–$50M+ Life Insurance Structure Built specifically for estate tax reduction, dynasty planning, and wealth transfer.

-

2. Minimal Out of Pocket Costs Your cash stays invested in real estate, business, or market opportunities. Not tied up in premiums.

-

3. Bank Lender Sourcing & Negotiation We coordinate direct premium financing with private banks and UHNW lending arms.

-

4. Estate Planning + ILIT Integration Attorney and CPA coordinated ILIT structures to ensure tax free inheritance.

-

5. Ongoing Monitoring & Stress Testing We treat your plan like a financial machine. Monitored. Optimized. Secured.

-

6. Multiple Exit Strategies We engineer refinancing, cash value exit, or liquidity event payoffs to protect you and your estate.

Book your free 30-minute consultation today. No pressure, just clarity.

All inquiries kept 100% Confidential

We’re here to help

👉 This is not insurance shopping.

This is a complete, engineered wealth strategy.

- 305-903-0363

- info@strategicpremiumfinance.com

HOW IT WORKS — 3 STEP SYSTEM

It’s the strategy wealthy families use to protect their assets, reduce future taxes, and build generational wealth without draining their cash.

How Premium Financing Works

STEP 1 → Strategy and Design

STEP 2 → Bank Pays the Premiums

STEP 3 → Growth, Protection, Legacy

REAL CONS → HOW WE TURN THEM INTO PROS

❌ Rising Interest Rates

✅ Our Solution

-

Stress Tested Plans

-

Rate Buffers

-

Conservative Leverage

-

Strong Lender Partnerships

Real Cons → How We Turn Them Into Pros

❌ Collateral Calls

✅ Our Solution

-

High Cash Value Policy Designs

-

Conservative Projections

-

Annual Monitoring

-

Automated Early Warning Systems

Real Cons → How We Turn Them Into Pros

❌ Policy Underperformance

✅ Our Solution

-

Top Rated Carriers

-

Multi Crediting Options

-

Long Term Growth Models

Real Cons → How We Turn Them Into Pros

❌ Loan Renewal Risk

✅ Our Solution

-

Lenders With Strong Renewal History

-

Multiple Lender Backup Plans

-

Clear Exit Strategies Built In

Real Cons → How We Turn Them Into Pros

❌ Complexity

✅ Our Solution

-

We Handle EVERYTHING:

-

Carriers • Banks • Attorneys • CPAs • Trusts • Stress Tests • Monitoring • Exit Planning

-

YOU get: a turnkey, engineered, proven financial structure.

BENEFITS FOR EVERY CLIENT TYPE

For Individuals & Families

- Preserve Cash

- Avoid Liquidating Investments

- Reduce Estate Taxes

- Build Multi Generational Wealth

- Provide Tax Free Benefits

- ILIT structures for maximum protection

For Business Owners

- Buy Sell Agreements

- Key Person Insurance

- Business Continuity

- Succession Planning

- Attract & Retain Top Executives

⭐ 1. Premium Financing Life Insurance

Get a multi million dollar life insurance policy without paying the premiums out of pocket. We use smart bank financing so you keep your cash invested while protecting your family and estate.

Get a custom premium financing plan engineered to protect your wealth with zero upfront premium.

⭐ 2. Captive Insurance Companies

Turn your business risk into profit. We help you create your own legal insurance company so you reduce taxes, control risk, and build another income stream like the Fortune 500.

We set up your entire captive from A to Z structure, compliance, underwriting, and strategy.

⭐ 3. Estate and Tax Planning

Protect your family and avoid the “estate tax trap.” We build tax efficient plans that keep more of your wealth in your bloodline not in government hands.

Get a personalized estate tax blueprint to protect millions for your family.

⭐ 4. Group Health and Group Life

Hire faster. Keep employees longer. Save money. We design group health and life plans that make your company more competitive without blowing up your budget.

We’ll build your entire benefits package and show you how to lower costs at the same time.

⭐ 5. Business Succession Planning

Make sure your business survives you and thrives after you. We create buy sell agreements, key person structures, and continuity plans that protect your company’s future and your family’s security.

Get a complete succession strategy to protect your business if something happens to you or a partner.

⭐ 6. Asset Protection

Shield your wealth from lawsuits, creditors, and tax risks. We use trusts, insurance structures, and legal strategies so your assets stay safe and your legacy stays intact.

Get your custom asset protection blueprint built to keep your wealth untouchable.

⭐ 7. High Cash Value Policy Engineering

We build custom high cash value life insurance policies designed for maximum growth, maximum liquidity, and maximum tax advantage used by top CEOs and investors.

Get a policy engineered to outperform traditional designs and unlock superior liquidity.

“Most clients qualify for 2–3 of these strategies at the same time. We custom build a wealth plan that uses multiple tools to reduce taxes, protect assets, and increase long term returns.”

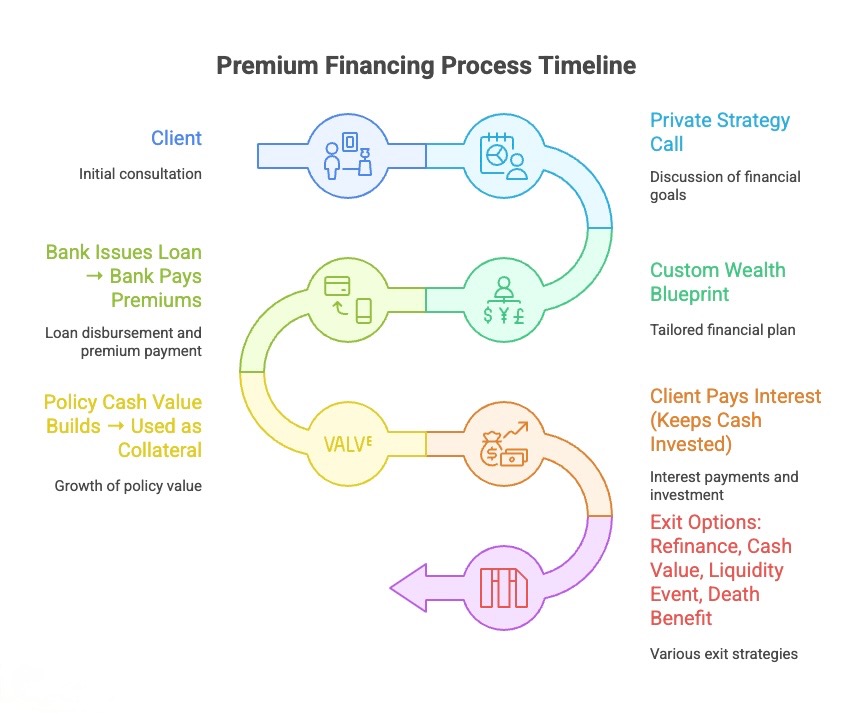

This diagram shows the full premium financing process in an easy, step by step way. It starts with you, the client, having a private strategy call to discuss your goals. After that, we create a custom wealth blueprint tailored to your financial situation. Once the plan is approved, the bank issues a loan and pays the insurance premiums for you. As the years go by, your policy grows cash value, which becomes the collateral for the loan. During this time, you only pay the interest, allowing you to keep your cash invested in business, real estate, or other opportunities. Finally, when the time is right, you choose the best exit strategy refinancing the loan, using the policy’s cash value, using money from a liquidity event, or simply letting the death benefit pay off the loan so the rest goes to your heirs tax free. The whole process is designed to protect your wealth while keeping your money working for you.

Flowchart Title: How Premium Financing Works

Step 1: Client

Initial consultation to review goals and financial suitability.

Step 2: Private Strategy Call

Deep discussion of financial goals, estate needs, liquidity, and long term planning.

Step 3: Custom Wealth Blueprint

We design a tailored premium financing strategy and policy structure.

Step 4: Bank Issues Loan → Bank Pays Premiums

Loan is approved and the bank pays the life insurance premiums directly to the carrier.

Step 5: Policy Cash Value Builds → Used as Collateral

As the policy grows, its cash value becomes the collateral supporting the loan.

Step 6: Client Pays Interest (Keeps Cash Invested)

Client pays only the loan interest while keeping their capital free for investments.

Step 7: Exit Options

Client can exit the plan through:

- Refinance the loan

- Use policy cash value to repay

- Use liquidity event proceeds

• Death Benefit loan is paid off and heirs receive remaining benefit tax free

Meet the Founder Marc Setton

Marc Setton built Strategic Premium Finance with one mission:

to help high net worth families preserve their wealth, avoid unnecessary taxes, and build lasting legacies without tying up their liquidity.

After years of working with wealthy families, business owners, and investors, Marc saw the same pattern:

Most people either:

❌ pay too much for life insurance, or

❌ avoid proper planning because premiums are too high.

Premium financing changes that.

Marc now designs intelligent, conservative, white glove wealth strategies that allow clients to:

- Keep their capital invested

- Protect their estates

- Engineer tax efficient wealth transfer

- Build multi generational wealth without financial strain

100% transparent.

100% private.

100% designed to protect the people you love.

What You Can Expect

Phase 1: Discovery

- Private consultation with our founder, Marc Setton

- Financial fact finding and goal alignment

- Identification of tax exposure and insurance inefficiencies

Phase 2: Strategy Design

- Custom financial blueprint

- Tax mitigation plan using advanced tools

- Presentation of optimized asset structures

Phase 3: Execution & Integration

- Implementation of premium financing, trusts, or captives

- Coordination with your existing legal/tax team

- Full white-glove service from onboarding to annual reviews

Required Documents Checklist (To Prepare for First Meeting if Possible)

- Recent tax returns (2 years)

- Business financials (if applicable)

- Insurance statements (life, health, commercial)

- Estate planning documents (wills, trusts)

- Investment account summaries

Book your private consultation today. No pressure, just clarity.

All inquiries kept 100% Confidential

We’re here to help

Let’s create something great together that will last beyond our years.

- 305-903-0363

- info@strategicpremiumfinance.com

Help Center

Frequently Asked Questions About Premium Finance and Estate Planning in Miami, Florida

Commonly ask Questions our clients have had. Can't find what you're looking for? Give us a call and we can go over your specific needs and concerns.

Our tax efficient life insurance plans are tailored to your risk tolerance and designed with robust safeguards, ensuring wealth preservation and estate tax reduction nationwide.

Absolutely. You retain full control of your investments, ILIT, and business succession planning decisions, including generation skipping trusts.

Typically designed for clients with $5 Million+ net worth, good credit, and strong cash flow to optimize estate planning and tax efficient life insurance benefits.

Our premium financing strategies include dynamic contingencies for rate changes to protect your estate tax reduction and wealth preservation goals.

Most tax efficient life insurance and business succession plans are implemented within 90 days, ensuring quick access to liquidity solutions nationwide.

Ready to Multiply Your Legacy WITHOUT Touching Your Liquidity?

You’ve earned your wealth.

Now protect it the right way strategically, tax efficiently, and intelligently.

High net worth strategies require precision.

This call will give you clarity, confidence, and a custom designed plan for your legacy.