How Premium Financing Works Keep Your Capital Working While Securing Your Legacy

Discover the proven strategy high net worth families use in Florida’s estate planning and wealth management to fund large life insurance policies without tying up their wealth.

Leverage premium financing, estate planning, captive insurance, and employee benefits to reduce taxes, protect assets, and build generational wealth.

What is Premium Financing Life Insurance and Why Do the Wealthy Use It?

You’ve built significant wealth; but are you sure it’s structured for high net worth financial planning that protects your family and maximizes your tax free legacy planning?

Why the Wealthy Leverage Premium Financing:

New Features

Are You Losing Millions to Estate Taxes & Illiquid Estate Plans? Discover Florida’s Estate Tax Reduction Strategies

Protect Your Legacy with Expert Premium Financing Life Insurance and Wealth Transfer Planning

-

Estate taxes can claim up to 50% of your assets without proper tax optimization

-

Selling investments or property to pay life insurance premium loans diminishes your net worth and reduces liquidity preservation

-

Leaving your heirs with a liquidity crisis can force fire sales and conflict, undermining inheritance protection and generational wealth

-

Rising insurance premiums draining cash flow despite premium financing strategies

-

Secure your legacy with expert wealth preservation and business succession planning

Book your free 15-minute consultation today. No pressure, just clarity.

All inquiries kept 100% Confidential

We’re here to help

Let’s create something great together that will last beyond our years.

- 305-903-0363

- info@strategicpremiumfinance.com

Take control of your wealth transfer and secure your family’s future today. Call now to schedule a free consultation with a wealth management specialist and learn how to optimize your estate plan for liquidity preservation and tax efficiency.

Fund Large Life Insurance Policies Without Sacrificing Your Liquidity

Premium Financing Life Insurance: A Strategic Approach to Liquidity Preservation Wealth Management

You’ve built your wealth. Now let us help you protect, multiply, and enjoy it with premium finance expertise.

Why Premium Financing Life Insurance Outperforms Traditional Financial Planning

Proven 4-Step Premium Finance Process for Estate Planning & Wealth Preservation

At Strategic Premium Finance, we deliver customized premium financing strategies nationwide to help you:

Plan Your Premium Financing Strategy

Grow Your Wealth & Preserve Estate Tax Efficiency

Fund with Captive Insurance and Liquidity Solutions

Protect Your Legacy and Business Succession Nationwide

Find Out if Premium Financing is Right for You?

Confidentiality & Trust

We operate under strict confidentiality standards and use encrypted systems to protect your data and privacy.

Final Thought

Your financial strategy should be as exceptional as your success.

Let’s build a tax-efficient, wealth-generating future—together.

Testimonials

Schedule Your Strategy Session

Ready to take action?

- info@strategicpremiumfinance.com

- 305-903-0363

- Serving High-Net-Worth Clients Nationwide

Who Qualifies for Premium Financing & How to Get Started

You May Qualify If You Are:

An investor or family office looking to enhance wealth protection and tax efficiency.

Common Misconceptions About Premium Financing & How to Overcome Them

Why not just pay for life insurance in cash?

The ultra-wealthy leverage financing to maximize returns. Keeping capital in investments often yields higher returns than paying premiums outright.

Is premium financing too risky?

Loans are structured to minimize risk. Policies are designed to withstand market fluctuations, and conservative lending ensures financial stability.

What if interest rates increase?

We design strategies with rate buffers, policy overfunding, and flexible loan terms to mitigate rising costs.

Real-World Case Study – How a $25M Investor Used Premium Financing to Secure $10M in Life Insurance

Client Profile:

- Real estate investor with a net worth of $25M

- Wanted a $10M life insurance policy but did not want to liquidate assets

The Challenge:

Paying $500K+ per year in insurance premiums would require liquidating high-growth investments.

The Solution:

- Used third-party financing to fund the policy instead of personal assets.

- Structured loan repayments using policy cash value & dividends.

The Results:

- After 15 years, the policy cash value significantly outgrew the loan balance.

- Heirs receive $10M+ tax-free, and the investment portfolio continued growing.

Why Premium Financing is a Game-Changer for High-Net-Worth Individuals

Would you rather:

Pay $500K+ per year in life insurance premiums?

OR Use a lender’s capital while keeping your money invested in high-growth assets?

This is why premium financing is the preferred strategy for sophisticated investors and business owners.

Take the First Step Secure Your Wealth Today

At Strategic Premium Finance, we specialize in helping high-net-worth individuals and business owners structure tax-efficient estate plans, leverage premium financing, and maximize their financial potential.

- 305-903-0363

- info@strategicpremiumfinance.com

- Serving High-Net-Worth Clients Nationwide

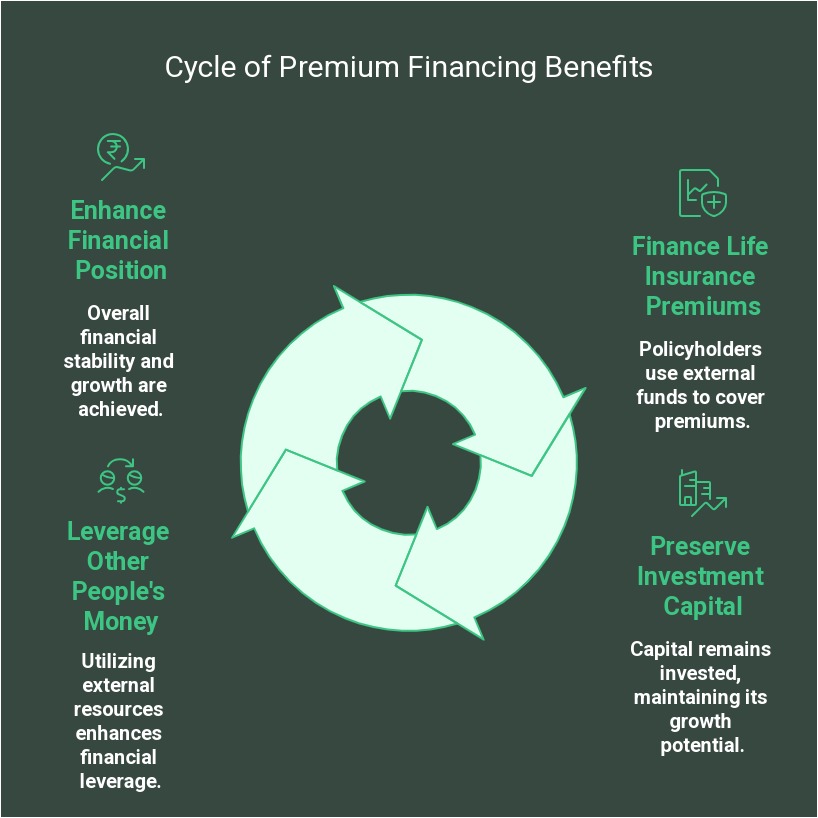

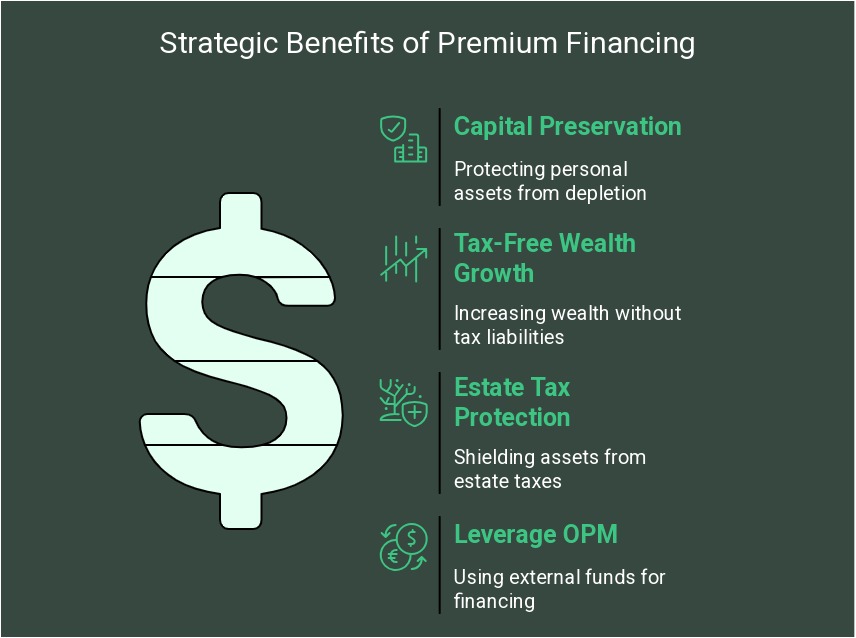

Leverage Wealth While Keeping Your Capital

Premium financing life insurance offers a strategic approach to securing substantial life insurance policies without the need to deplete personal cash flow. This page outlines the key benefits of premium financing, including capital preservation, tax-free wealth growth, estate tax protection, and the ability to leverage other people’s money (OPM) for financing.

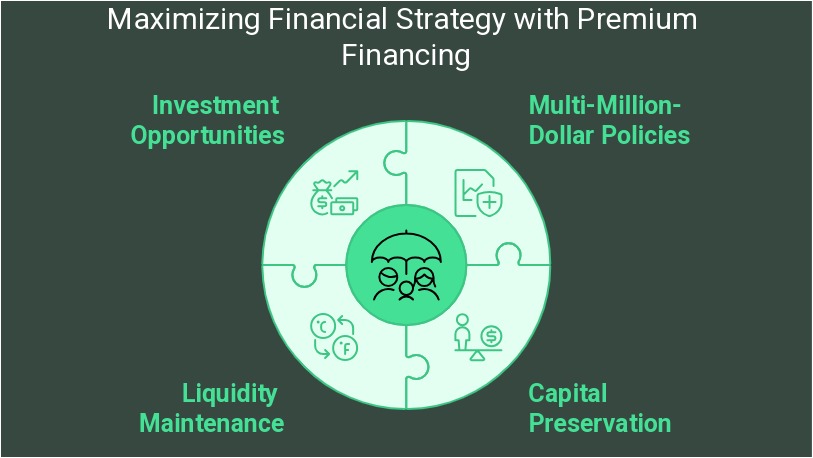

Preserve Capital

With premium financing, individuals can secure multi-million-dollar life insurance policies while preserving their personal capital. This approach allows policyholders to maintain their liquidity and invest their cash flow in other opportunities, thus maximizing their overall financial strategy.

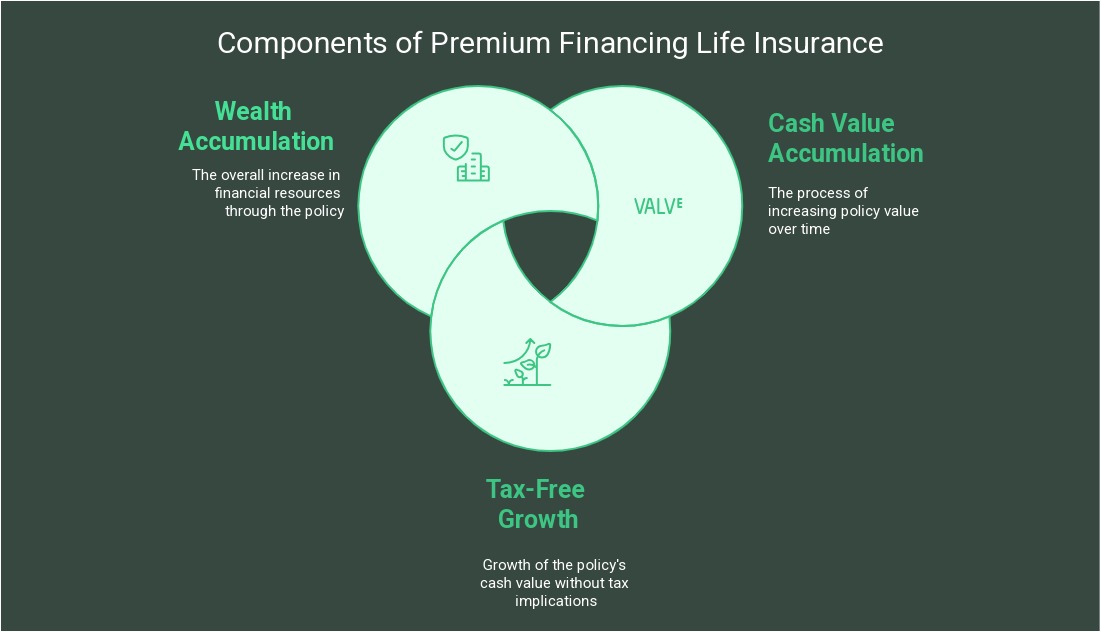

Tax-Free Wealth Growth

One of the most significant advantages of premium financing life insurance is the ability to build a high-yield, tax-free cash value policy. As the policy accumulates value over time, the growth remains tax-free, providing a powerful tool for wealth accumulation and financial planning.

Estate Tax Protection

Life insurance can serve as an effective mechanism for reducing estate tax burdens. By utilizing premium financing, individuals can ensure that their family wealth is protected from excessive taxation upon their passing, allowing for a smoother transfer of assets to heirs.

Leverage Other People’s Money (OPM)

Premium financing enables policyholders to finance their life insurance premiums while keeping their investment capital working for them. By leveraging other people’s money, individuals can enhance their financial position without sacrificing their existing investments or cash flow.